As the digital risk landscape shifts, so too must the operational strategy for Credit Unions in Ireland. The Central Bank's recent IT risk review isn’t just a recommendation, it’s a firm mandate with an 18-month deadline that directly impacts your Credit Union’s leadership.

This critical assessment is the first step on your essential journey toward full Digital Operational Resilience Act (DORA) compliance. For many leaders, navigating these advanced IT risk and security requirements can create a significant “governance gap.” The question is, how can you confidently ensure your Credit Union is protected and compliant in an increasingly complex digital threat landscape?

Ignoring this directive isn’t an option. The financial penalties, operational disruptions and severe reputational damage from non-compliance are simply too high to risk. This is the moment to transform a regulatory burden into a strategic advantage for your digital future.

Are You Truly Prepared? Join Our Exclusive Webinar

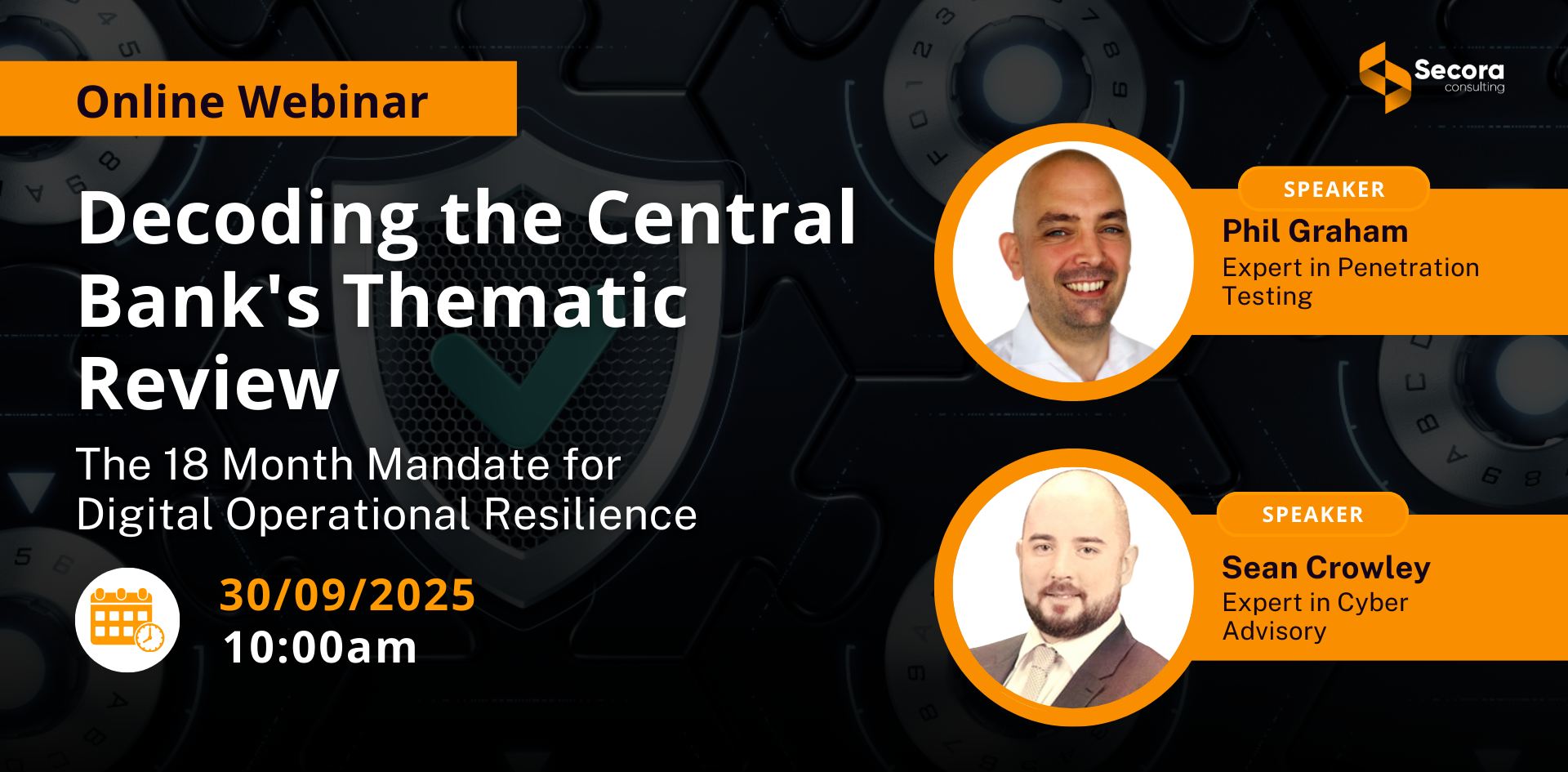

To help you gain the clarity and confidence you need to meet this mandate head-on, we invite you to join our exclusive live webinar on Decoding the Central Bank's Thematic Review: The 18 Month Mandate for Digital Operational Resilience.

In this webinar, we will cut through the complexity of the Central Bank’s findings and DORA, equipping you with actionable insights that you can implement immediately.

What You Will Learn:

- Understanding the Mandate: Get a deep dive into the Central Bank’s Thematic Review and its direct implications for your Credit Union.

- Proactive Cyber Defences: Learn a strategic approach to security testing and grasp the critical differences between Vulnerability Assessments and Penetration Testing.

- Simulating the Real Threat: Understand why intelligence driven testing, which simulates real world threat actors, is now an essential, mandatory approach.

- Collaborative Defence Enhancement: Discover the crucial ‘what next?’ after a penetration test and learn how to prioritise and implement actionable security enhancements.

- A 3-Step Framework for Compliance: We’ll walk you through our proven framework to Diagnose Your Gaps, implement “Remediation Accelerators,” and ensure “Independent Validation”.

This webinar isn’t just about meeting regulatory obligations; it’s about building a more secure, resilient and trusted institution for your members by empowering your team and board with the knowledge to proactively safeguard your operations and future proof your digital capabilities.

Webinar Details

- Date: 30th September 2025

- Time: 10:00 AM IST

- Speakers: Phil Graham , Director and Penetration Testing Expert | Sean Crowley , Director and Cyber Advisory Expert

Ready to secure your Credit Union’s future? Register for the Webinar here